🫂Order Insurance (Stop-Loss Insurance)

📌 The insurance function in the PVP-AMM protocol allows traders to insure any of their perpetual trading orders. The insurance ratio ranges from 10% to 50% of the Trade Margin¹, with a total of 5 types of insurance (at the interval of 10). Once the trades are settled or liquidated, the losing trader can claim up to the same amount as the Trade Margin¹.

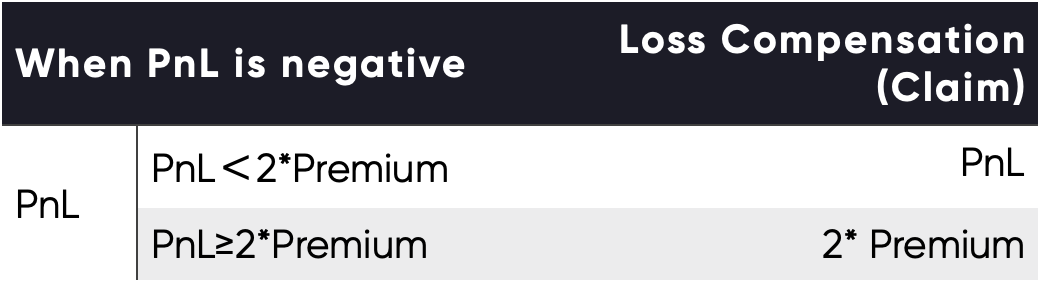

📌 If the order loses money:👇

▪️ PnL< 2*Premium, then: Claim Amount = PnL ▪️ PnL≥ 2Premium, then: Claim Amount = 2Premium

📌 Order insurance can greatly increase the loss threshold under any circumstances at the cost of sacrificing some expected profits. As a trading aid, it is more suited for long-term investors and risk traders who pursue high leverage.

📌 Traders can formulate different insurance strategies for the same type of trading. Trading with different insurance ratios will generate multiple positions where profits and losses are calculated independently. New trades with the same insurance ratio will be merged with existing positions (conventional method), where the current profits and losses, as well as the insurance status will be calculated together after the merge.

Last updated